Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

An IRS taxpayer refers to an individual or entity that is obligated to pay taxes to the Internal Revenue Service (IRS), the tax collection agency of the United States federal government. Taxpayers are required to report their income, deductions, and credits on tax returns and pay the appropriate amount of taxes determined by the IRS.

Who is required to file irs taxpayer?

Any individual or entity that meets certain income thresholds or has certain types of income or assets is required to file a tax return with the IRS. The specific requirements depend on various factors such as filing status, age, and sources of income. Generally, if your income exceeds a certain threshold, you are required to file a tax return. It is always best to consult the IRS guidelines or a tax professional to determine your specific filing obligations.

How to fill out irs taxpayer?

To successfully fill out the IRS taxpayer form, also known as Form 1040, follow the given steps:

1. Gather all necessary documents: Gather your W-2 forms, 1099s, and any other documents related to your income and expenses. Make sure you have all the required information before starting.

2. Personal Information: Provide your name, address, and Social Security number (SSN) at the top of the form. Include your dependents' information, if applicable.

3. Filing Status: Choose your filing status: Single, Married filing jointly, Head of household, etc. This determines your tax rates and eligibility for certain credits.

4. Income: Report your total income on the appropriate lines. Use the separate sections of the form to report different types of income such as wages, self-employment income, interest, dividends, etc. Include any necessary tax withholding information.

5. Adjusted Gross Income (AGI): Calculate your AGI by subtracting adjustments (such as educator expenses, student loan interest, etc.) from your total income. Enter this figure on the corresponding line.

6. Deductions and Credits: Determine whether you will claim the standard deduction or itemize deductions. Fill in the proper boxes and claim any relevant credits, such as the Child Tax Credit or Earned Income Tax Credit.

7. Taxes and Payments: Calculate your federal tax liability and compare it to the amount of tax withheld from your paychecks. If you owe additional tax, make sure to pay it by the filing deadline to avoid penalties and interest.

8. Signature: Sign and date the form electronically or manually if mailing a paper return. If you're married filing jointly, ensure your spouse also signs the form.

9. Additional Schedules: Attach any additional schedules, if needed. For instance, if you have self-employment income or certain deductions, you may need to complete supplemental forms.

10. Review and Submit: Before submitting the form, review all the information, double-check for any errors, and ensure that you haven't missed anything important.

Remember, tax laws can be complex, and it's advisable to seek professional assistance or consult the IRS instructions for further guidance if you have specific questions or circumstances.

What is the purpose of irs taxpayer?

The purpose of the IRS (Internal Revenue Service) taxpayer is to ensure compliance with federal tax laws and collect taxes from individuals and businesses. The IRS is responsible for administering and enforcing the Internal Revenue Code by processing tax returns, conducting audits, providing taxpayer assistance, and collecting taxes owed. Their primary goal is to promote voluntary compliance with tax laws and maintain the integrity of the tax system.

What information must be reported on irs taxpayer?

The information typically required to be reported on an IRS taxpayer includes:

1. Personal information: This includes the taxpayer's full legal name, social security number (or taxpayer identification number), address, and contact information.

2. Filing status: The taxpayer must specify their filing status, which can be Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er) with Dependent Child.

3. Income: The taxpayer must report all sources of income earned throughout the year, including wages, salaries, tips, self-employment income, rental income, investment income (such as dividends and interest), and other forms of income.

4. Deductions: Taxpayers must report any eligible deductions they claim, such as mortgage interest, student loan interest, medical expenses, charitable donations, and state and local taxes paid.

5. Credits: Taxpayers must report any eligible tax credits they are claiming, including the Child Tax Credit, Earned Income Tax Credit, Education credits, and other applicable credits.

6. Taxes paid: The taxpayer must report any federal income tax already paid, such as withheld taxes from their paycheck, estimated tax payments, or any other tax credits or payments applied.

7. Health insurance coverage: Taxpayers must indicate if they had qualifying health insurance coverage or if they qualify for an exemption from the requirement to have coverage, as mandated by the Affordable Care Act.

8. Additional forms and schedules: Depending on the taxpayer's specific situation, they may need to attach additional forms and schedules to report various types of income, deductions, or credits. Examples include Schedule A for itemized deductions or Schedule C for self-employment income.

It's important to note that tax reporting requirements can vary depending on individual circumstances, so it's always advisable to consult the official IRS guidelines or seek professional tax advice when preparing a tax return.

When is the deadline to file irs taxpayer in 2023?

The IRS tax filing deadline for individual taxpayers in 2023 is typically April 18th. However, it is always advisable to check for any changes or extensions announced by the IRS closer to the tax season.

What is the penalty for the late filing of irs taxpayer?

The penalty for late filing of an IRS taxpayer depends on whether you owe taxes or are due a refund. Here are the potential penalties:

1. Late Filing Penalty: If you fail to file your tax return by the due date (usually April 15th), the penalty is usually 5% of the unpaid tax for each month or part of a month the return is late. The penalty starts accruing from the day after the due date and can reach a maximum of 25% of your unpaid taxes.

2. Late Payment Penalty: If you owe taxes and fail to pay by the due date, the penalty is generally 0.5% of the unpaid tax for each month or part of a month the tax remains unpaid. This penalty also starts accruing from the day after the due date and can reach up to 25% of your unpaid taxes.

3. Failure to File and Failure to Pay Penalty: If you both fail to file your tax return and fail to pay your taxes, you'll face both penalties mentioned above, resulting in a combined maximum penalty of 5% per month (up to 47.5% of unpaid taxes).

Note: If you're due a refund and don't owe any taxes, there is no penalty for filing a late return. However, it's important to file your return within three years to claim any refund you may be eligible for.

It's worth mentioning that the IRS may consider reasonable cause and grant relief from penalties under certain circumstances, such as serious illness, natural disasters, or other unforeseen events that hindered timely filing/payment.

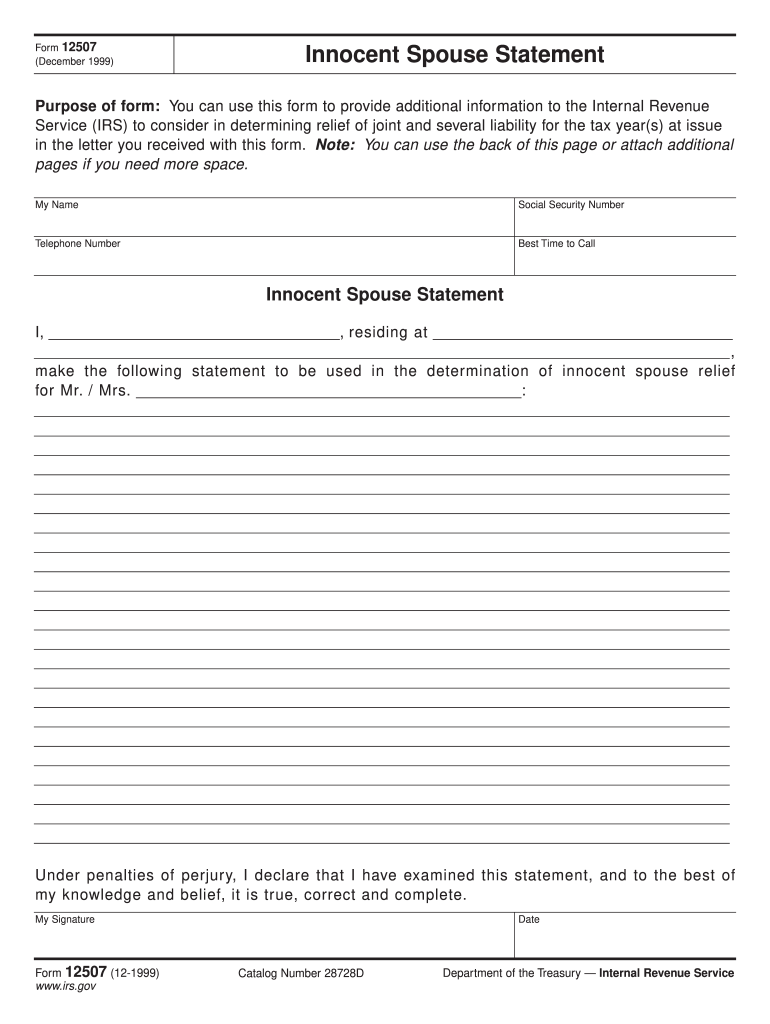

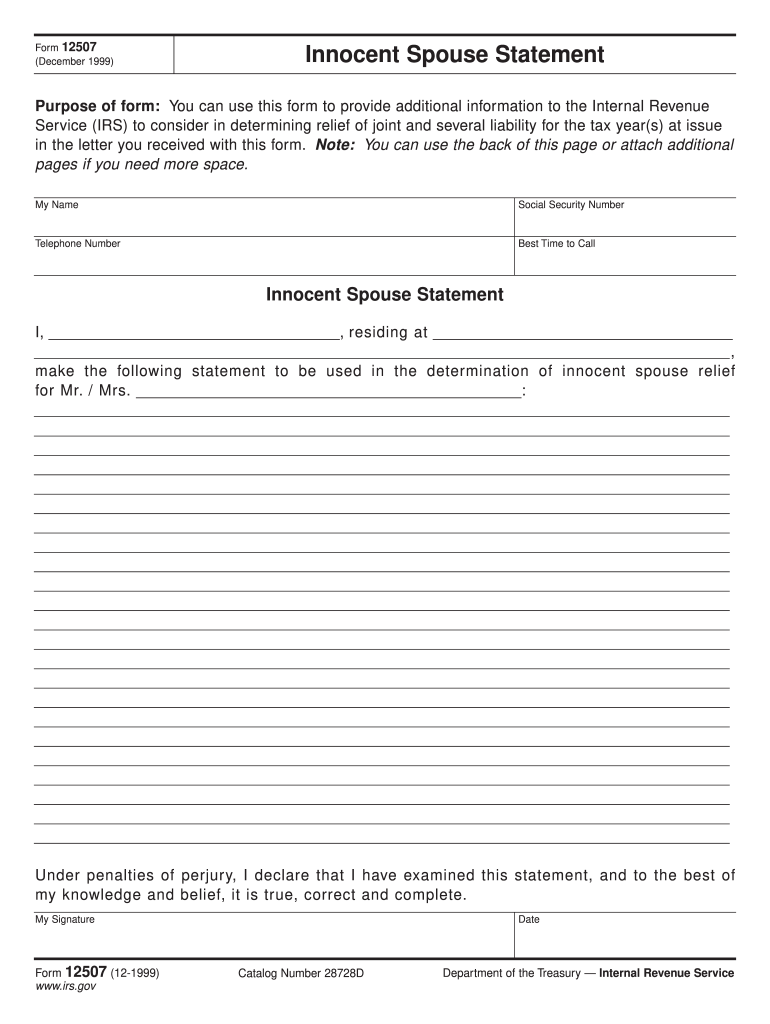

How do I edit innocent spouse statement in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing account form information and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the relief information in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your relief provide and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete irs taxpayer on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your spouse relief form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.