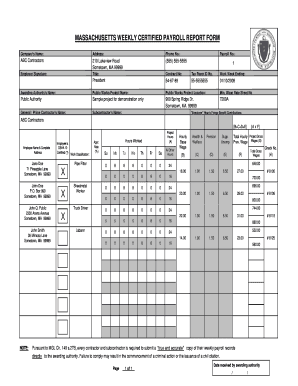

Get the free payroll report form

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your payroll report form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll report form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit massachusetts certified payroll form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out payroll report form

How to fill out Massachusetts payroll form:

01

Obtain a copy of the Massachusetts payroll form. This can usually be found on the official website of the Massachusetts Department of Revenue or obtained from your employer.

02

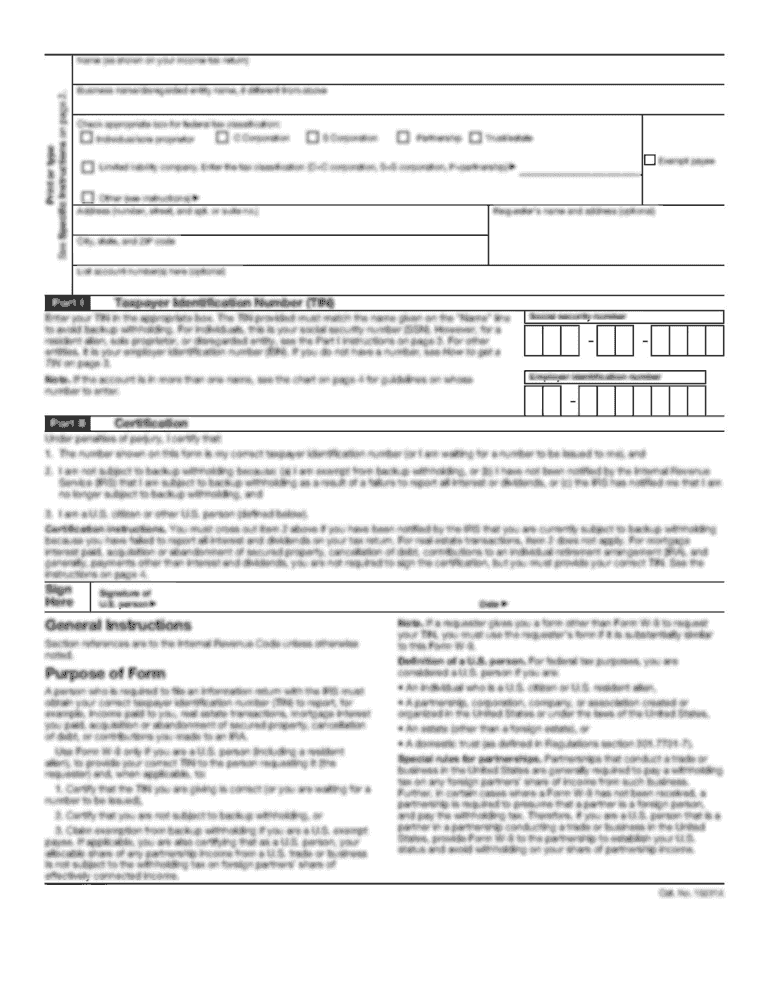

Fill in your personal information, such as your name, address, and Social Security Number. Make sure this information is accurate and up to date.

03

Provide your employer's information, including their name, address, and federal employer identification number (FEIN). This information should be available from your employer.

04

Record your earnings for the designated pay period. This includes your gross wages before any deductions, as well as any overtime, tips, bonuses, or commissions.

05

Deduct any pre-tax contributions or deductions, such as retirement contributions, health insurance premiums, or flexible spending account contributions.

06

Calculate and withhold the appropriate taxes from your earnings. This includes federal income tax, state income tax, Social Security tax, and Medicare tax. Use the W-4 form to determine your federal income tax withholding, and consult the Massachusetts payroll tax tables for the state income tax withholding.

07

Add any other deductions or withholdings, such as wage garnishments or child support payments.

08

Subtract the total deductions and withholdings from your gross earnings to determine your net pay.

09

Sign and date the form, and provide any additional information or documentation required by your employer or the Massachusetts Department of Revenue.

Who needs Massachusetts payroll form:

01

Employers in Massachusetts are required to provide and maintain accurate payroll records for each employee. This includes filling out and retaining payroll forms for each pay period.

02

Employees in Massachusetts may need to fill out the Massachusetts payroll form to report their earnings, deductions, and taxes to their employer and the state government. This ensures proper withholding and reporting of taxes.

03

Self-employed individuals in Massachusetts may also need to fill out the Massachusetts payroll form to report their earnings and taxes to the state government. This helps them comply with state tax laws and obligations.

Fill weekly payroll report : Try Risk Free

People Also Ask about payroll report form

What is the payroll tax in Massachusetts?

How do I fill out a payroll report?

Does Massachusetts have a state withholding form?

How much is employer payroll tax in Massachusetts?

Does Massachusetts have a payroll tax?

What is the Massachusetts state tax withholding?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file massachusetts payroll form?

The employer is required to file Massachusetts Payroll Form WR-1, Employer's Annual Reconciliation of Massachusetts Income Tax Withheld. This form is due by February 28 of the following year.

What is the purpose of massachusetts payroll form?

The Massachusetts Payroll Form is used to report employee wages and other information to the Massachusetts Department of Revenue. It is used to calculate payroll taxes, such as income tax, Social Security tax, and Medicare tax. It is also used to report employee wages to the state for unemployment insurance and workers' compensation insurance.

When is the deadline to file massachusetts payroll form in 2023?

The deadline to file Massachusetts payroll taxes in 2023 is April 15, 2024.

What is massachusetts payroll form?

Massachusetts Payroll Form refers to the specific forms that employers in Massachusetts are required to submit to report their employees' wages and taxes withheld to the Massachusetts Department of Revenue (DOR). These forms are used to ensure compliance with state income tax withholding requirements and to calculate and remit the appropriate taxes to the state.

Some common Massachusetts payroll forms include:

1. Form M-941: Massachusetts Employer's Quarterly Return of Income Taxes Withheld - Employers use this form to report and pay state income tax withheld from employees' wages on a quarterly basis.

2. Form M-3: Massachusetts Annual Return of Income Taxes Withheld - Employers use this form to report and pay state income tax withheld from employees' wages annually.

3. Form M-945: Massachusetts Annual Return of Withholding - Employers use this form to report and pay state income tax withheld from non-payroll payments, such as pensions, annuities, and gambling winnings.

4. Form WR-1: Employer's Contribution Report - Employers use this form to report and pay contributions for unemployment insurance, workforce training fund, and municipal or regional college fee on a quarterly basis.

It is important for employers in Massachusetts to stay updated with the latest versions of these forms and comply with all reporting and payment requirements to avoid penalties or fines. Employers should consult the Massachusetts Department of Revenue or a qualified tax professional for specific guidance regarding their payroll responsibilities.

How to fill out massachusetts payroll form?

To fill out the Massachusetts payroll form, you will need to follow these steps:

1. Obtain the necessary forms: Get the Massachusetts payroll form from the Massachusetts Department of Revenue (DOR) website or contact them to request a paper copy.

2. Collect employee information: Gather details about each employee, including their full name, address, Social Security number, and date of hire.

3. Calculate wages and deductions: Determine the wages earned by each employee for the pay period and calculate the appropriate deductions (e.g., federal and state income taxes, Social Security, Medicare, etc.).

4. Fill out the form: Use the information collected to complete the payroll form. This may involve filling in boxes, providing numbers, or checking off applicable checkboxes. Follow the specific instructions provided on the form.

5. Report earnings and deductions: Record the wages earned for the pay period in the appropriate section of the form, as well as any deductions taken from the employee's pay.

6. Calculate and report taxes withheld: Calculate the amount of state income taxes withheld from each employee's paycheck and report it on the form accordingly.

7. Calculate and report employer taxes: Determine the amount of employer taxes owed, such as state unemployment taxes, and report these on the form as required.

8. Submit the form: Keep a copy of the completed form for your records and submit the original to the Massachusetts Department of Revenue by the specified deadline. Ensure you follow any additional instructions for submission, such as mailing address or online filing procedures.

It is important to note that these instructions provide a general overview, and the specific requirements and forms can vary. Therefore, it is recommended to refer to the instructions provided on the form itself or contact the Massachusetts Department of Revenue for any specific questions or clarifications.

What information must be reported on massachusetts payroll form?

The information that must be reported on a Massachusetts payroll form includes:

1. Employer's identification number (EIN) or social security number

2. Employer's name and address

3. Employee's social security number

4. Employee's name and address

5. Withholding information, including federal and state income tax withheld from the employee's wages

6. Non-resident withholding information (if applicable)

7. Dependent care and/or transit benefits (if applicable)

8. Any additional state-specific deductions or taxes (such as the Earned Income Credit or the Community College tax)

9. Total wages paid to the employee during the reporting period

10. Employer contributions to employee benefits or retirement plans (if applicable)

11. Any additional information required by the Massachusetts Department of Revenue (DOR) for tax purposes.

It is important to note that these requirements may vary depending on the specific Massachusetts payroll form being used and any changes in state laws or regulations. Therefore, employers should consult the official instructions provided by the Massachusetts DOR for the specific form being filed to ensure accurate reporting.

What is the penalty for the late filing of massachusetts payroll form?

The penalty for late filing of Massachusetts payroll forms varies depending on the specific form. For example, the penalty for late filing of the Massachusetts Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return (Form MA DOR 941) is $100 per month for each month that the return is late, up to a maximum of $1,500 or 150% of the tax due, whichever is less.

It is important to note that penalties may differ for different forms or tax obligations, and it is recommended to consult with the Massachusetts Department of Revenue (DOR) or a tax professional for accurate and up-to-date penalty information specific to your situation.

How can I edit payroll report form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your massachusetts certified payroll form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit certified report straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing massachusetts payroll form right away.

How do I fill out the certified wage massachusetts form on my smartphone?

Use the pdfFiller mobile app to complete and sign massachusetts weekly certified payroll report form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your payroll report form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certified Report is not the form you're looking for?Search for another form here.

Keywords relevant to certified payroll report form

Related to massachusetts weekly payroll

If you believe that this page should be taken down, please follow our DMCA take down process

here

.