Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

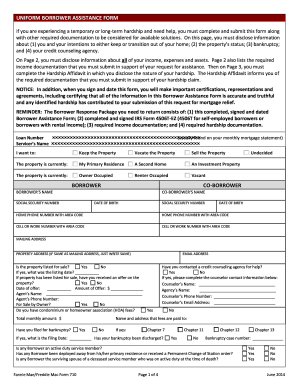

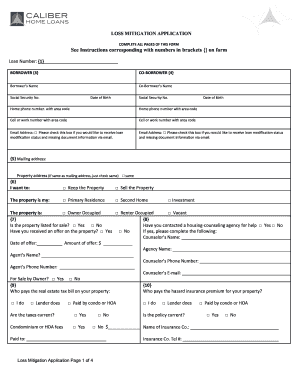

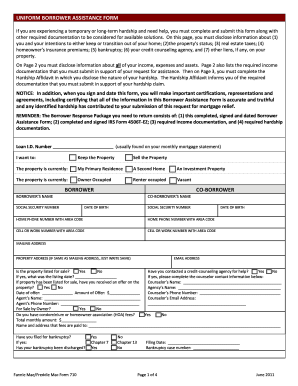

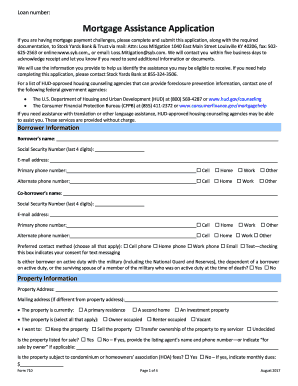

What is the purpose of uniform borrower assistance form?

The Uniform Borrower Assistance Form (UBAF) is a form used by the U.S. Department of Housing and Urban Development (HUD) to help homeowners who are struggling to make their mortgage payments. This form helps homeowners apply for assistance from HUD’s loan modification program, which can help them keep their homes. The UBAF assists homeowners in gathering the necessary documents, such as proof of income, needed to complete the loan modification application.

What information must be reported on uniform borrower assistance form?

The information required on a Uniform Borrower Assistance Form includes the borrower's name, address, Social Security number, date of birth, loan type, loan number, loan balance, current payment amount, date of delinquency, and any other financial information requested by the lender.

When is the deadline to file uniform borrower assistance form in 2023?

The deadline to file a uniform borrower assistance form will vary based on the type of loan and lender. Generally, borrowers should contact their lender to determine the specific deadlines for their loan.

What is uniform borrower assistance form?

The uniform borrower assistance form is a standardized document used by lenders and loan servicers to assess the eligibility of borrowers for various types of mortgage assistance programs. This form is typically required for borrowers seeking loan modifications, repayment plans, forbearance, or other forms of assistance to help them avoid foreclosure or manage financial hardship. The form collects detailed information about the borrower's financial situation, assets, income, and expenses, which is then used to evaluate their qualification for different assistance options. The goal of the uniform borrower assistance form is to streamline the application process and ensure consistent evaluation of borrowers across different lenders and loan programs.

Who is required to file uniform borrower assistance form?

The uniform borrower assistance form is typically required to be filed by individuals who are seeking assistance with their mortgage loan. This form is commonly used by borrowers who are going through financial hardship and are unable to make their mortgage payments. It is usually requested by the lender or loan servicer in order to assess the borrower's eligibility for loan modification, forbearance, or other forms of mortgage assistance.

How to fill out uniform borrower assistance form?

To fill out a uniform borrower assistance form, follow these steps:

1. Gather the necessary documents: Before starting the form, collect all the required documents such as pay stubs, bank statements, tax returns, mortgage statements, and any other financial records that may be requested.

2. Provide your personal and contact information: Begin by entering your name, social security number, address, phone number, and email address. This ensures that the lender can easily reach you and verify your identity.

3. Indicate your loan information: Provide details about your loan, including the loan number, property address, and the name of the loan servicer or lender. This information helps the lender identify and locate your loan file.

4. Select the assistance program you're applying for: Choose the specific assistance program you are seeking, such as loan modification, forbearance, or repayment plan. Read the instructions carefully to ensure you choose the correct option.

5. Provide your income information: Fill in your current employment details, including your employer's name, address, phone number, and the length of your employment. Additionally, detail your monthly income and indicate how frequently you receive payment (weekly, bi-weekly, monthly).

6. List your monthly expenses: Provide an itemized breakdown of your monthly expenses, including housing costs (mortgage or rent), utilities, insurance, transportation, groceries, childcare, and any other regular expenses. Be as accurate as possible to give the lender an understanding of your financial situation.

7. Explain your financial hardship: Describe the circumstances that have caused your financial hardship and explain why you require assistance. Be honest and provide any supporting documentation, such as medical bills, layoff notices, or divorce papers, to support your claim.

8. Attach supporting documents: Attach all the required supporting documents, such as pay stubs, bank statements, tax returns, and any additional paperwork requested by the form. Make sure to organize and label the documents properly to avoid confusion.

9. Review and sign the form: Carefully review all the information you provided to ensure accuracy. Once confident, sign and date the form, acknowledging that the information provided is true and accurate to the best of your knowledge.

10. Submit the form: Send the completed form along with the required supporting documents to the relevant address provided by your lender or loan servicer. You may be required to submit the form via mail, email, or through an online submission portal. It's best to verify the submission method with your specific lender.

Remember to keep a copy of the filled-out form and all supporting documents for your records.

What is the penalty for the late filing of uniform borrower assistance form?

The penalty for the late filing of the uniform borrower assistance form can vary depending on the specific circumstances and the lender's policies. However, some potential consequences of late filing may include late fees, a negative impact on credit score, and potentially a delay or denial of the requested borrower assistance. It is important to check with the specific lender to understand their policies and any potential penalties for late filing.

How can I manage my uniform borrower assistance form directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your ubaf form 710 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit loss mitigation application form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your hardship assistance application into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit ubaf form on an iOS device?

Create, modify, and share form 710 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.