7 Best Small Business Credit Card Processors in 2024

Streamline Your Payments: Handpicked Solutions for Optimized Payment Processing

- Save on processing fees or get $200 back guaranteed

- Get the green light with a 98% approval rate

- 24/7 industry-leading support + free equipment

- Accepts in-store, online, mobile, & Apple payments

Leaders Merchant Services offers a 98% approval rate, many features, and top-tier customer service while also accepting high-risk businesses. Plus, your contract includes a free, high-quality terminal, making it a top choice for most merchants.

- 98% approval rate

- High-risk friendly

- Same-day onboarding

- Budget-friendly interchange-plus pricing

- Cash advances and business loans

- Fully compliant

- Limited range of available hardware

- A few hidden compliance and software fees

- No setup/application fees, free card terminal training

- $200 meet-or-beat guarantee on rates

- Trusted by over 25,000 businesses

Flagship’s easy online application form is ideal for business owners who want to painlessly set up a merchant account and accept credit card payments as soon as possible. Its month-to-month contracts also mean you can try this merchant services provider practically risk free.

- $200 meet-or-beat guarantee

- Negotiable pricing structure

- Dedicated account managers

- Same-day setup

- Lack of transparency

- Monthly minimum fee

- Flat rate pricing ensures predictable, low costs

- Process unlimited transactions without a monthly fee

Square is a big name in payment processing, offering robust hardware and easy sign-up to start processing payments immediately. Its simple plans and transparent flat-fee pricing are appealing, making it a popular choice for many merchants.

- Transparent pricing with optional monthly fees

- No contracts

- Start accepting payments instantly

- Handles PCI compliance for you

- Higher-than-average per-transaction fees

- Difficult to contact support

- Specialist support for high-volume businesses

- Accepts merchants often turned away by competitors

PaymentCloud is known for high approval rates, helpful customer support, and multi-channel solutions. Contracts come with free equipment, and reprogramming existing hardware is easy. Plans are affordable and personalized to meet your needs.

- Accepts high-risk businesses

- 98% approval rate

- Free, same-day e-commerce setup

- Lack of transparency

- Early termination fees apply

- Get same-day payouts for deposits into Chase biz accounts

- Grow your business w/ a customer buying habits tracker

Chase offers same-day funding, flat rate pricing, and robust e-commerce features, ideal for small- to mid-sized businesses. It supports a variety of payment methods, provides strong security, and comes with advanced POS hardware.

- Standard next- and same-day funding

- Simple flat rate pricing with no hidden fees

- Helpful mobile app

- No free hardware or hardware leasing

- No PCI compliance support

- 0% markups, no contracts, no batch or annual fees

- Built-in reporting tools with 24/7 support + free card reader

Stax is a great subscription-based credit card processing service that offers affordable transaction fees, intuitive payment software, and e-commerce functionality. High-volume businesses can save money with Stax over a processor with a traditional fee-only payment model.

- Save up to 40% with simple subscription-style pricing

- Advanced analytics software

- Robust, modern software at no extra cost

- Optional same-day payouts

- Can't accept PayPal

- Sales-focused support

- Flat fees as low as $59/mo - 0% markups

- TrustPilot: 4.8 stars out of 5, BBB A+ Rating

Payment Depot offers substantial savings with no transaction percentage markup, just a low monthly subscription fee. It comes with a free modern terminal, easy e-commerce integrations, and 24/7 customer support.

- Save up to 40% with simple subscription-style pricing

- Setup in as little as 24 hours

- Free modern terminal

- No option for same-day processing

- Support is hard to reach

Hungry for Efficiency? Try POS System to Level Up Your Service

- Customize your package with tailored pricing available

- No commitments - no contracts, no cancellation fees

- Boost growth & accept payments from multiple countries

- Customize your package with tailored pricing available

What Is Credit Card Processing?

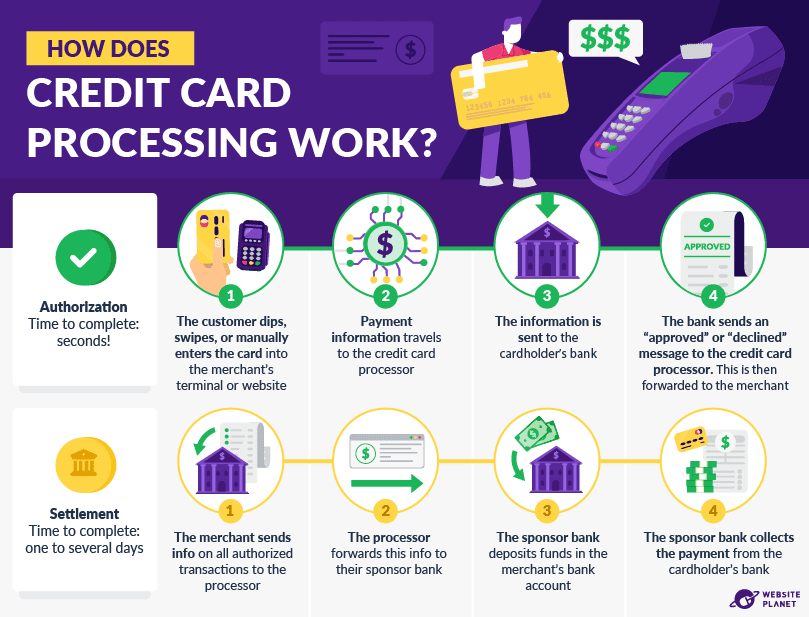

Credit card processing looks like a simple and instant process, but it actually consists of several interlocking steps. Your credit card processor is the entity that connects a bunch of moving parts to make sure your business can accept payments, which is why it’s so important to have a good one.

The process starts when a consumer initiates a payment with their card. The information is then shared with the merchant, who collects the details. Once the merchant gets the card information, they send it to their credit card processor, which then sends it to the card network. The card network passes the information to the consumer’s bank.

The bank verifies that the consumer has enough funds/credit, then approves or declines the transaction, and tells the merchant’s credit card processor. Once the bank approves a transaction, your card processor releases the funds to your merchant account.

The consumer’s bank notifies you of the payment’s approval or denial. That’s what happens when you see the notification of an approved transaction on your card reader or virtual terminal.

And finally, there’s the settlement process: the official transfer of the money from the consumer’s bank to your bank. This process is not always instant, and can even take days, depending on the consumer’s card network.

The settlement process is also when any processing fees are taken from the total amount. These fees will vary based on the credit card processor you’ve chosen.

How To Pick the Best Credit Card Processing Service for Your Business

First, there are a few basic requirements you should keep in mind. You’re looking for:

- Transparent pricing

- Payment security. PCI compliance at the minimum.

- Enough payment types allowed. Customers expect choice.

- Customer support. This stuff can be tricky for a business of any size, so it’s important to be able to get help.

But aside from these basics, the most important factors are your business size, expenses, and income. Understanding this will help you figure out which card processing service costs the least for you in the long run.

If you’re a high-risk business – in a taboo industry or with mixed credit history – then regular processing may not be sufficient. Instead, you should look for services with a special high-risk focus. These include vendors offering advanced fraud protection features to protect high-risk merchants, like placing holds on customer accounts that require additional verification.

If your business is small or just getting started, you may want to prioritize services that save time and are easy to use. That means looking for providers that onboard quickly, sync well with other platforms, and are clear about prices.

Another necessary point of consideration is finding a good point of sale (POS) system. Most credit card processors offer a POS system that combines hardware and software, so you can take in-person, online, and mobile payments without having to contract multiple services.

However, processors package their POS offerings differently. For example, some services have good card-reading terminals, but they come with a hefty up-front cost on top of your existing account fees. Meanwhile, other providers offer free equipment depending on the contract you choose.

Even if you find a processor that has an attractive POS package, you’ll need to double-check if the software will work with your existing set-up. If you have an e-commerce store, for instance, you’ll want to ensure the processor’s virtual terminal can integrate with your site’s shopping cart.

How Much Does Credit Card Processing Cost?

Almost all credit card processors impose an interchange fee. An interchange fee is composed of two parts: a percentage of that transaction, and a flat charge for every transaction. (It will look something like this: 2.6% + 10¢.) The interchange fee varies on the credit card, the size of the transaction, and whether a purchase was in-person or online.

Additionally, most credit card processors impose a monthly subscription fee. (Or an upfront cost for a certain amount of time, like three years, that is displayed as a monthly rate.) Sometimes processors call this an equipment or software fee.

You may also encounter chargeback fees over disputed payments. Chargeback fees cover the costs banks incur when a customer disputes a previous transaction and asks for their money back. Chargeback fees range from $15 to $50, plus the transaction fee.

You can dispute chargeback fees, but it can be time-consuming and complicated. Luckily, some credit card processors have dedicated chargeback departments that offer specialist support.

There are a few more costs that are common, but not universal, among credit card processors. Many will sell you card-reading equipment for a one-time fee (though some have free device options). Some will charge fees for the use of online payment gateways. Other processors issue markup fees on transactions too.

That’s why it’s important to find a processor that’s upfront about their fees – for example, some vendors state plainly that they won’t markup interchange rates.

Lastly, some companies allow you to negotiate for the lowest rate possible based on the services you do (and do not) require, as well as factors like your industry, transaction volume, and average transaction amount. This can result in significant savings, especially with companies that try to beat your current processor’s rates.

Many processors bundle various software integrations, “free” equipment, and e-commerce solutions in their plans. The ability to choose a custom service at a custom price means that you only pay for what you actually need, helping to keep your processing costs as low as possible.

It depends on where you live. In the US, businesses can deduct expenses that are ‘necessary’ and ‘ordinary.’ As credit card processing fees are as necessary and ordinary for business as can be, some of those costs can indeed be written off.

It’s on you to make sure you (or your accountant) understand the relevant tax law and document everything adequately. That’s why you’ll probably want a credit card processing service that makes documentation easy with automatic reporting and QuickBooks integration.

Frequently Asked Questions

While it depends on your unique situation, the best services overall are Square Payments, Payment Cloud, and Chase. They offer free hardware and competitive pricing, while also being relatively easy to use.

Most credit card processors offer POS systems that work with their services. If you already have a POS system from another company (digital and/or physical), you’ll need to check whether your preferred credit card processor can work with it.

Your online store may already have credit card processing built-in. If not, or if you just prefer another service, many credit card processors integrate with leading e-commerce website builders such as BigCommerce and WooCommerce.

Yes. Credit card processing is needed for all credit card transactions, regardless of whether those transactions are purchases or donations

About us

We are a group of business experts from around the world – from researchers to veteran brick-and-mortar business owners, and everything in between. Our goal is to pool our knowledge to help small businesses save money in a world full of confusing options and hidden fees.

We read into the nitty-gritty details of credit card processors’ contracts, test their card readers and online payment gateways, and keep track of which processors are actually easy to use so you don’t have to. After all, running a business is already hard enough.