Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

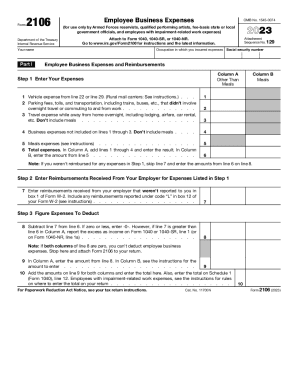

Form 2106 is a tax form used by employees to deduct work-related expenses that were not reimbursed by their employer. These expenses can include travel, transportation, meals, entertainment, and home office expenses. It is used to calculate and claim the deduction for these expenses incurred while performing job duties.

Who is required to file form 2106?

Form 2106 is typically filed by employees who incur work-related expenses that are not reimbursed by their employer. These expenses must be necessary for the employee to perform their job duties and must not be of a personal nature.

How to fill out form 2106?

To fill out Form 2106, Employee Business Expenses, follow the steps below:

1. Gather your records: Collect all the necessary documentation, such as receipts, invoices, and any other supporting documents related to your employee business expenses.

2. Complete the personal information section: Enter your name, social security number, and any other required personal information at the top of the form.

3. Calculate your vehicle expenses: If you used your own vehicle for business purposes, calculate your total mileage, both personal and business-related. Fill in the required details, such as the total miles driven, business miles driven, and any parking fees or tolls paid. Calculate the deductible vehicle expenses by multiplying the business miles by the standard mileage rate (or actual expenses if you choose to use the actual expense method).

4. Report other business expenses: List all non-vehicle related employee business expenses in Part II of the form. Common expenses include travel, meals, entertainment, supplies, and professional dues. Provide a detailed description of each expense, the date, and the amount paid.

5. Calculate your total expenses: Add up all your vehicle and non-vehicle expenses to determine your total employee business expenses.

6. Calculate the amount reimbursed: If your employer has reimbursed you for any of these expenses, subtract the reimbursement amount from your total expenses.

7. Determine if you are subject to the 2% AGI limitation: The 2% adjusted gross income (AGI) limitation means that employee business expenses are only deductible if they exceed 2% of your AGI. If your total miscellaneous deductions (including employee business expenses) are less than 2% of your AGI, you will not be able to claim them.

8. Complete the calculation of deductible expenses: Subtract the reimbursement amount and any non-deductible expenses (due to the 2% AGI limitation) from your total expenses. This will give you the final deductible amount.

9. Transfer the deductible expenses to your tax return: The deductible expenses from Form 2106 are reported on Schedule A (itemized deductions) of your Form 1040 tax return.

Note: Make sure to keep a copy of the completed Form 2106 and all supporting documents in case of an audit. It's always recommended to consult a tax professional or use tax software for assistance with filling out tax forms.

What is the purpose of form 2106?

Form 2106, also known as the Employee Business Expenses form, is used to report business-related expenses that are not reimbursed by your employer. The purpose of Form 2106 is to allow employees to deduct these qualified unreimbursed business expenses from their taxable income, thus reducing their overall tax liability. This form is typically used by taxpayers who are employed and incur expenses as part of their job, such as travel costs, vehicle expenses, professional dues, and other work-related expenditures.

What information must be reported on form 2106?

Form 2106, also known as Employee Business Expenses, is used to report ordinary and necessary expenses incurred while performing job-related duties. The following information must be reported on this form:

1. Personal Information: Name, address, social security number (or employer identification number), and occupational code of the employee.

2. Job-Related Vehicle Expenses: If you use your own vehicle for business purposes, you must report the total number of miles driven for business, commuting, and personal use. Additionally, expenses such as fuel, repairs, depreciation, and lease payments related to the business use of the vehicle should be reported.

3. Travel Expenses: This includes costs incurred while traveling away from home on business, such as airfare, lodging, meals, and transportation.

4. Meals and Entertainment Expenses: You must report meal and entertainment expenses that are directly related to your job duties, as well as those incurred while entertaining clients or business associates.

5. Office-in-Home Expenses: If you maintain an office in your home that is exclusively used for your job, you can report expenses related to that space, such as rent, utilities, and insurance.

6. Other Deductible Expenses: Any other ordinary and necessary business expenses that are not covered by the previous categories, such as professional memberships, subscriptions to industry-related publications, and job-specific equipment or tools.

It's important to note that starting from tax year 2018, unreimbursed employee business expenses are no longer deductible for most employees due to changes in tax laws. Therefore, it is advisable to consult with a tax professional or refer to the IRS guidelines for specific details and eligibility criteria regarding the deductions associated with Form 2106.

When is the deadline to file form 2106 in 2023?

The deadline to file Form 2106 for the tax year 2023 will be on April 15, 2024. However, if April 15 falls on a weekend, the deadline will be shifted to the next business day. It's always recommended to check with the Internal Revenue Service (IRS) or a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of form 2106?

The penalty for the late filing of form 2106 varies depending on the situation. If you are an employee and you file your tax return late without an approved extension, you may be subject to a penalty for late filing. The penalty is typically 5% of the unpaid tax liability per month, up to a maximum of 25%. However, if you can show a reasonable cause for filing late, the penalty may be waived. It's important to consult with a tax professional or refer to the IRS guidelines for specific information related to your situation.

How do I edit form 2106 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your irs form pdf, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit irs form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 2106.

How do I edit irs 2106 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign irs form print right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.