4 Best Credit Card Processors for eCommerce Sites in 2024

Choosing the right credit card processor means more than just finding the lowest rates. Many merchants are caught out by hidden fees, costly equipment, and poor quality service. We researched the market to find out which processors combine competitive rates with a trustworthy and reliable service. Use our chart below to discover which company offers the right combination of features for you.

Streamline Your Payments: Handpicked Solutions for Optimized Payment Processing

- 98% approval rate for merchant sign-up applications

- Cash advances and loans to help you get started

- Easily accepts mobile payments, including Apple Pay

- Fast set-up thanks to same-day account approval

- Just 0.03% + $0.10 per transaction for online payments

- Powerful API integrates seamlessly with your store

- Over 70 payment methods in more than 120 global markets

- Specialist support for high-volume businesses

- Accepts merchants often turned away by competitors

- Loan amount: $5K - $1M

- Time in Business: 12+ months

- Average Monthly Revenue: At least $19,000

- Get same-day payouts for deposits into Chase biz accounts

- Grow your business w/ a customer buying habits tracker

Hungry for Efficiency? Try POS System to Level Up Your Service

What Is Credit Card Processing?

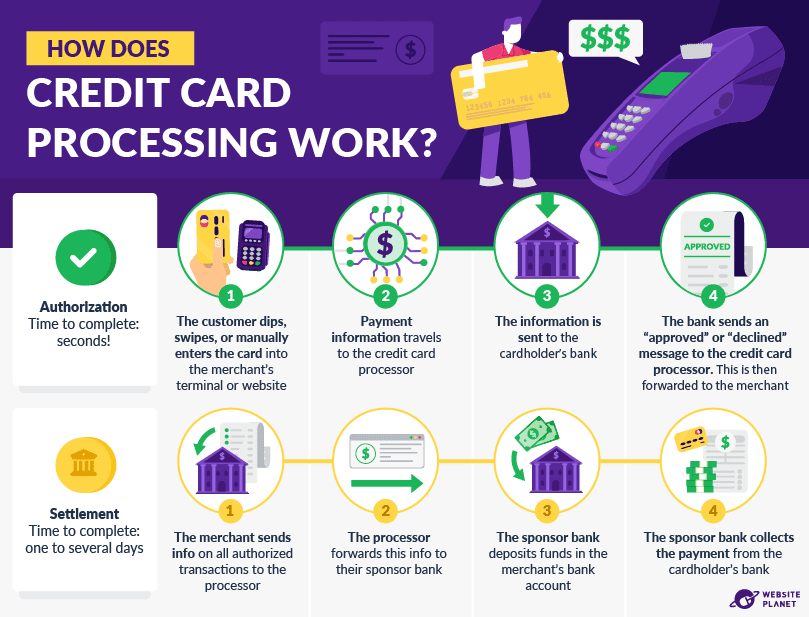

Credit card processing looks like a simple and instant process, but it actually consists of several interlocking steps. Your credit card processor is the entity that connects a bunch of moving parts to make sure your business can accept payments, which is why it’s so important to have a good one.

The process starts when a consumer initiates a payment with their card. The information is then shared with the merchant, who collects the details. Once the merchant gets the card information, they send it to their credit card processor, which then sends it to the card network. The card network passes the information to the consumer’s bank.

The bank verifies that the consumer has enough funds/credit, then approves or declines the transaction, and tells the merchant’s credit card processor. Once the bank approves a transaction, your card processor releases the funds to your merchant account.

The consumer’s bank notifies you of the payment’s approval or denial. That’s what happens when you see the notification of an approved transaction on your card reader or virtual terminal.

And finally, there’s the settlement process: the official transfer of the money from the consumer’s bank to your bank. This process is not always instant, and can even take days, depending on the consumer’s card network.

The settlement process is also when any processing fees are taken from the total amount. These fees will vary based on the credit card processor you’ve chosen.

How To Pick the Best Credit Card Processing Service for Your Business

First, there are a few basic requirements you should keep in mind. You’re looking for:

- Transparent pricing

- Payment security. PCI compliance at the minimum.

- Enough payment types allowed. Customers expect choice.

- Customer support. This stuff can be tricky for a business of any size, so it’s important to be able to get help.

But aside from these basics, the most important factors are your business size, expenses, and income. Understanding this will help you figure out which card processing service costs the least for you in the long run.

If you’re a high-risk business – in a taboo industry or with mixed credit history – then regular processing may not be sufficient. Instead, you should look for services with a special high-risk focus. These include vendors offering advanced fraud protection features to protect high-risk merchants, like placing holds on customer accounts that require additional verification.

If your business is small or just getting started, you may want to prioritize services that save time and are easy to use. That means looking for providers that onboard quickly, sync well with other platforms, and are clear about prices.

Another necessary point of consideration is finding a good point of sale (POS) system. Most credit card processors offer a POS system that combines hardware and software, so you can take in-person, online, and mobile payments without having to contract multiple services.

However, processors package their POS offerings differently. For example, some services have good card-reading terminals, but they come with a hefty up-front cost on top of your existing account fees. Meanwhile, other providers offer free equipment depending on the contract you choose.

Even if you find a processor that has an attractive POS package, you’ll need to double-check if the software will work with your existing set-up. If you have an e-commerce store, for instance, you’ll want to ensure the processor’s virtual terminal can integrate with your site’s shopping cart.

How Much Does Credit Card Processing Cost?

Almost all credit card processors impose an interchange fee. An interchange fee is composed of two parts: a percentage of that transaction, and a flat charge for every transaction. (It will look something like this: 2.6% + 10¢.) The interchange fee varies on the credit card, the size of the transaction, and whether a purchase was in-person or online.

Additionally, most credit card processors impose a monthly subscription fee. (Or an upfront cost for a certain amount of time, like three years, that is displayed as a monthly rate.) Sometimes processors call this an equipment or software fee.

You may also encounter chargeback fees over disputed payments. Chargeback fees cover the costs banks incur when a customer disputes a previous transaction and asks for their money back. Chargeback fees range from $15 to $50, plus the transaction fee.

You can dispute chargeback fees, but it can be time-consuming and complicated. Luckily, some credit card processors have dedicated chargeback departments that offer specialist support.

There are a few more costs that are common, but not universal, among credit card processors. Many will sell you card-reading equipment for a one-time fee (though some have free device options). Some will charge fees for the use of online payment gateways. Other processors issue markup fees on transactions too.

That’s why it’s important to find a processor that’s upfront about their fees – for example, some vendors state plainly that they won’t markup interchange rates.

Lastly, some companies allow you to negotiate for the lowest rate possible based on the services you do (and do not) require, as well as factors like your industry, transaction volume, and average transaction amount. This can result in significant savings, especially with companies that try to beat your current processor’s rates.

Many processors bundle various software integrations, “free” equipment, and e-commerce solutions in their plans. The ability to choose a custom service at a custom price means that you only pay for what you actually need, helping to keep your processing costs as low as possible.

It depends on where you live. In the US, businesses can deduct expenses that are ‘necessary’ and ‘ordinary.’ As credit card processing fees are as necessary and ordinary for business as can be, some of those costs can indeed be written off.

It’s on you to make sure you (or your accountant) understand the relevant tax law and document everything adequately. That’s why you’ll probably want a credit card processing service that makes documentation easy with automatic reporting and QuickBooks integration.

Frequently Asked Questions

While it depends on your unique situation, the best services overall are Leaders Merchant Services, Paysafe, and PaymentCloud. They offer free hardware and competitive pricing, while also being relatively easy to use.

Most credit card processors offer POS systems that work with their services. If you already have a POS system from another company (digital and/or physical), you’ll need to check whether your preferred credit card processor can work with it.

Your online store may already have credit card processing built-in. If not, or if you just prefer another service, many credit card processors integrate with leading e-commerce website builders such as BigCommerce and WooCommerce.

Yes. Credit card processing is needed for all credit card transactions, regardless of whether those transactions are purchases or donations.

About us

We are a group of business experts from around the world – from researchers to veteran brick-and-mortar business owners, and everything in between. Our goal is to pool our knowledge to help small businesses save money in a world full of confusing options and hidden fees.

We read into the nitty-gritty details of credit card processors’ contracts, test their card readers and online payment gateways, and keep track of which processors are actually easy to use so you don’t have to. After all, running a business is already hard enough.