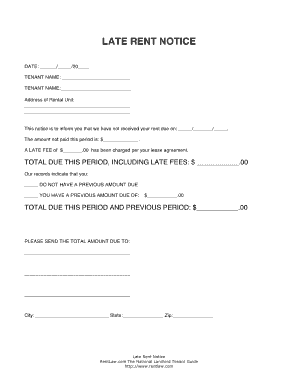

Get the free tax credit lease form

Get, Create, Make and Sign

How to edit tax credit lease form online

How to fill out tax credit lease form

How to fill out tax credit lease form:

Who needs tax credit lease form:

Video instructions and help with filling out and completing tax credit lease form

Instructions and Help about residential tax credit lease blank form

Hey doing this is Joe from Ibiza agreement calm, and I'm going to guide you through how you fill out a standard lease agreement okay the first part we have the term of the lease agreement how many months is it going to be a typical residential lease agreement is 12 months, so we're just going to write 12 right in here beginning at least usually begins on the first day of a month, and we'll just do January the year 2013 let's say it starts in the future, and it ends on I'll say December 31st 2013 when you lease landlord will just make the landlord be landlord ink with a mailing address of 9v landlord legs 3 put in the landlord's address on the city of landlord Villa state of York zip code well I don't know he's in codes in New York, so I'll actually get to Florida 3 3 1 39 which is Miami Beach and the tenant will just say his name is Joseph 10 man and the Landlord agrees to lease the premises located at we'll just do our office address which is 90 Alton Road I won't say the suite city of Miami Beach and Florida three point three one three and if the carpet is or condo or house or whatever it is has ain't furnishings you'd put it in here like let's say we're leaving them desks and couches, but you can put in there whatever you want this is sounding like more of an office lease, but this is still a residential if there are any restrictions like you know some of these can kind of be silly like now must have shoes on an elevator, but it can be whatever you want, and you can actually if you have a lot of restrictions right something like see attachment and put all your restrictions in a separate attachment to this document this is just used as you're going to be being a typical tenant which is just doing your date typical day-to-day things there and this is where the landlord will be telling you if you can make any alterations most landlords say no which means that you can't paint put in a dishwasher replace a dishwasher do anything without the tenants I mean the landlord's approval, so the tenant can't do anything for the most part if this is checked off pets will say that the tenant is not allowed to have a pet and then this is if someone's blind they say have a dog and why you have that dog Pollock most of the time because you're blind there any minor children you have to list them in here and this is the box where you write it the rule the landlord writes in the rule of you know how many days can a guest stay there for most landlords say a week, but it can be anything that you want this is what you write in the rent we'll just say the rent is $1,000 1,000 payable in the name what do you want the checks made out to which is a landlord Inc say they're doing the first every month beginning January 1st 2013, and typically you have the red cent somewhere well I know a lot of buildings have Dropbox, but we'll just say that we want the rent sent to 95 Alton Road, so the landlord will be living right next door or there's another way you can just write the...

Fill residential tax credit lease make : Try Risk Free

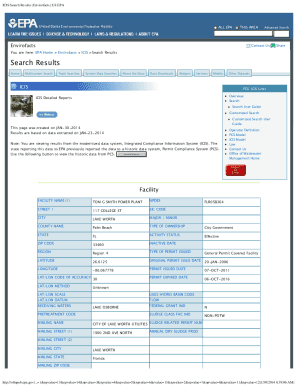

People Also Ask about tax credit lease form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tax credit lease form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.