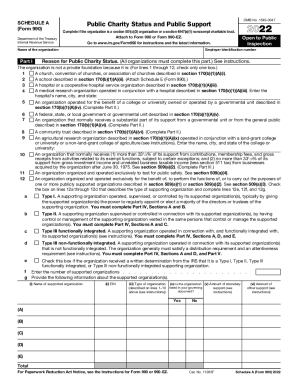

What is the purpose of the Schedule A (Form 990 or 990-EZ)?

The Schedule A (Form 990 or 990-EZ) is a public charity status and public support schedule that must be filed by any organization that files Form 990 or Form 990 EZ, in order to provide necessary information about public support status.

Who must file IRS 990 Schedule A?

An organization that agreed with Part 4 and line 1 of form 990 has to fill out the Schedule A (Form 990 or 990-EZ). In addition, any organization under section 501(c)(3) that filed form 990-EZ has to fill this schedule. This includes:

- Organizations described in section 501(c)(3);

- Non-exempt charitable trusts described in section 4947 (a)(1) and treated as private foundations;

- Organizations described in section 501(e) or 501(f) or 501(j) or 501(k) and 501(n).

When is the Schedule A (Form 990 or 990-EZ) due?

Every filing organization must file the form by the 15th day of the 5th month after the organization's accounting period ends (May 15th for a calendar-year filer). If the due date falls on a Saturday, Sunday, or legal holiday, file on the next business day. A business day is any day that is not a Saturday, Sunday, or legal holiday.

What accounting method should be used for the Schedule A (Form 990 or 990-EZ)?

When accounting for the Schedule A (Form 990 or 990-EZ), organizations must use the same method of accounting as checked on the Form 990-EZ line G or Form 990, Part XII, line 1.

How do I fill this form?

The Schedule A (Form 990 or 990-EZ) needs the name of the organization and EIN along with detailed information regarding the public support for the organization.

Part I. Reason for public charity status. If the subordinates do not all have the same public charity status, then check the public charity status box for the largest number of subordinates in the group, and explain on Schedule A (Form 990 or 990-EZ), Public Charity Status and Public Support, Part IV. However, if any section 509(a)(3) organizations are among the subordinates in the group return, also answer lines 11e through 11g.

Parts II and III. Support statements. Report aggregate data for all subordinates with the public charity status corresponding to Parts II or III.

Parts IV through VI. In addition to Part I in paragraph 18, if any section 509(a)(3) organizations are among the subordinates in the group return, also complete the relevant sections of Parts IV and V. If an answer in Part IV requires more information with respect to any section 509(a)(3) organizations, then answer with respect to those organizations and provide that additional information in Part VI. For instance, if the group includes 50 sections 509(a)(3) organizations, and one of them does not list all of its supported organizations by name in its governing documents, then answer “No,” to Part IV, Section A, line 1, and explain in Part VI. If the group includes more than one Type III non-functionally-integrated supporting organization, then provide aggregate data in Part V.

Where do I send the completed Schedule A (Form 990 or 990-EZ)?

The form must be sent to:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0027