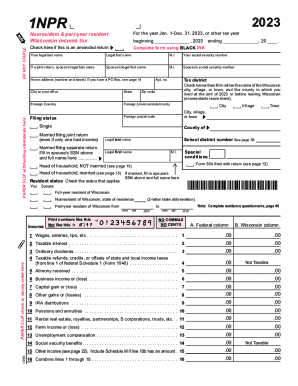

WI DoR 1NPR 2017 free printable template

Get, Create, Make and Sign

Editing wisconsin 1npr form 2017-2019 online

WI DoR 1NPR Form Versions

Instructions and Help about wisconsin 1npr form 2017-2019

Law.com legal forms guide form one NPR non-resident individual income tax return part of your residents and non-residents who 0 state income tax on wages earned in Wisconsin document and file these with a form 1 NPR this document can be obtained from the website of the Wisconsin Department of Revenue step 1 if you are filing an amended return indicate this with a check mark at the top of the first page step 2 those who are filing on a fiscal year basis should enter the starting and ending dates of the period in question step 3 give your name and social security number as well as that of your spouse if filing jointly enter your address step 4 enter the city town or village where income was earned the county and its school district number step 5 indicate your filing status with a check mark step 6 indicate your residence status with a check mark if a non-resident give the two letter abbreviation of your state of residence if a part year resident give the beginning and ending dates of your residence in the state step 7 to questions just below are only for Wisconsin residents working in Minnesota or vice versa step 8 lines 1 through 16 provide instructions for detailing your income step 9 line 17 through 31 provide instructions for detailing adjustments to your income step 10 adjust gross income is calculated on lines 32 through 34 step 11 lines 35 through 66 provide instructions for calculating tax owed if claiming an itemized deduction on line 41 first complete schedule 1 on page 4 if claiming a married couple credit applicable only if both spouses earned taxable income in the state on line 56 complete schedule to step 12 lines 67 threw 83 adjust your tax or refund owed after all credits are applied to watch more videos please make sure to visit laws calm

Fill form : Try Risk Free

People Also Ask about wisconsin 1npr form 2017-2019

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your wisconsin 1npr form 2017-2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.