NE DoR Form 6 2021-2024 free printable template

Show details

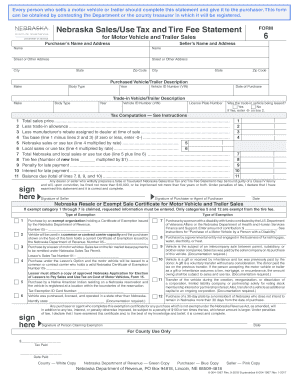

RESETPRINTNebraska Sales/Use Tax and Tire Fee StatementFORM6for Motor Vehicle and Trailer SalesPurchasers Name and Address Sellers Name and AddressNameNameStreet or Other AddressStreet or Other AddressCityCityStateZip

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ne form sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ne form sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ne form sales tax printable online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nebraska form 6. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

NE DoR Form 6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ne form sales tax

How to fill out Nebraska form 6?

01

Begin by obtaining Nebraska form 6 from the appropriate source, such as the Nebraska Department of Revenue website or local tax office.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Gather all the necessary information and documents required to complete the form, such as personal identification details, income information, and any supporting documentation.

04

Start filling out the form by entering your personal information, including your name, address, and social security number.

05

Provide details about your income, including wages, salaries, and any other sources of income you may have.

06

Include any deductions or exemptions that you are eligible for, ensuring you follow the instructions provided on the form.

07

If you had any withholding taxes during the tax year, report the amounts accordingly.

08

Carefully review all the information provided on the form to ensure accuracy and make any necessary corrections or additions.

09

Sign the form and submit it according to the instructions provided.

Who needs Nebraska form 6?

01

Individuals who are Nebraska residents and are required to file a state income tax return need to complete Nebraska form 6.

02

Nebraska form 6 is specifically for those individuals who earned income from sources other than Nebraska but are claiming a Nebraska income tax credit.

03

Nonresidents who earned income in Nebraska but are residents of another state also need to fill out Nebraska form 6 to claim any applicable credits or deductions.

Video instructions and help with filling out and completing ne form sales tax printable

Instructions and Help about nebraska form 6 printable

Fill nebraska sales and use : Try Risk Free

People Also Ask about ne form sales tax printable

How do I get a Nebraska sales tax ID number?

How do I become tax exempt in Nebraska?

What is the sales tax form for vehicles in Nebraska?

What's the difference between estate tax and inheritance tax?

How do I avoid inheritance tax in Nebraska?

What is a form 706N in Nebraska?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nebraska form 6?

Nebraska Form 6 is an income tax return form for the state of Nebraska. It is used to report income from wages, salaries, tips, interest, dividends, capital gains, pensions, annuities, and other sources. The form also includes information about deductions, credits, and other tax-related matters.

Who is required to file nebraska form 6?

Nebraska Form 6 is a tax form required to be filed by all Nebraska residents who have income from any source other than wages, salaries, tips, or other employee compensation.

What information must be reported on nebraska form 6?

Nebraska Form 6 is the state's income tax return form. It requires taxpayers to report their total income and any deductions and credits they are claiming. It also requires taxpayers to report information such as Social Security numbers, filing status, and any other information requested by the Nebraska Department of Revenue.

When is the deadline to file nebraska form 6 in 2023?

The deadline to file Nebraska Form 6 in 2023 is April 15, 2024.

What is the penalty for the late filing of nebraska form 6?

The Nebraska Department of Revenue does not assess any late filing penalty for Form 6. However, if you owe taxes and do not pay them by the due date, you may be assessed a late payment penalty of 5% of the unpaid tax amount plus interest.

How to fill out nebraska form 6?

Nebraska Form 6 is used to report nonresident income and deductions in the state of Nebraska. To fill out this form, follow these steps:

1. Download and print a copy of Nebraska Form 6 from the Nebraska Department of Revenue website.

2. Section A: Personal Information

- Fill in your name, Social Security number, and address.

- Check the appropriate box to indicate whether you are an individual or a fiduciary.

3. Section B: Income

- Report all Nebraska-source income earned during the tax year.

- Include income from wages, salaries, tips, commissions, self-employment, rental income, etc.

- Attach copies of federal income tax returns and schedules that support the amounts reported.

4. Section C: Deductions

- List any deductions you qualify for, such as business expenses, rental expenses, or other allowed deductions.

- Attach copies of supporting documents, such as receipts or invoices, for each deduction claimed.

5. Section D: Nebraska Tax Liability

- Calculate your Nebraska tax liability based on the income reported in Section B and deductions claimed in Section C.

- Follow the instructions on the form to determine your tax liability.

6. Section E: Payments and Credits

- Enter any payments or credits you have made, including estimated tax payments and withholding from wages.

- Attach copies of any supporting documentation, such as W-2s or 1099s.

7. Section F: Refund or Additional Tax Due

- Compare your tax liability from Section D to the payments and credits from Section E.

- If you paid more than your tax liability, you may be entitled to a refund. Enter the amount in the appropriate box.

- If you owe additional tax, enter the amount in the appropriate box.

8. Sign and Date the form.

9. Make a copy of the completed form for your records before mailing it to the Nebraska Department of Revenue. Ensure you attach any necessary supporting documents as mentioned above.

Please note that these instructions are a general guide, and it's always a good idea to consult with a tax professional or the Nebraska Department of Revenue for specific guidance related to your individual tax situation.

What is the purpose of nebraska form 6?

Nebraska Form 6 is an application or petition for a change of name for an individual. Its purpose is to legally request a change in the name of a person as recorded in official documents and records. This form is typically used in situations such as a name change after marriage, divorce, adoption, or any other personal reason to change one's legal name.

How can I edit ne form sales tax printable from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your nebraska form 6 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit nebraska form 6 fillable online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your ne sales use tax to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit form 6 tax on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute ne form 6 from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your ne form sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Form 6 Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to form 6 nebraska

Related to nebraska sales tax form 6

If you believe that this page should be taken down, please follow our DMCA take down process

here

.